test234243222

Published on 12/4/2025

Market participants are currently attaching a ~21% probability to a 25 bps rate hike by the Fed by Dec-23. While there is room for one final round of rate hike before 2023 ends (between the two policy reviews scheduled on Nov 1st and Dec 13th), elevated US yields for medium-long tenors could obviate the need for incremental monetary tightening. This is going to be a close call. Going forward, market participants expect the Fed to commence its rate easing cycle from Jun-24 onwards.

Chart 3: Upward pressure on long term yields reflects expectations of rates remaining ‘higher for longer’

Data: Refinitiv, QuantEco Research

3. Outlining our expected rupee trajectory

Notwithstanding the Indian rupee’s tendency to sporadically flirt with its record low levels in FY 2023-24 so far, the price action continues to be marked by extremely low levels of volatility. In fact, with a 1.2% depreciation on FYTD basis, INR stands out as one of the best performing major currencies (barring Brazilian riyal and Polish zloty).

While India’s relatively strong post COVID economic recovery continues to provide an anchor for INR, there are concerns building up in the near-term.

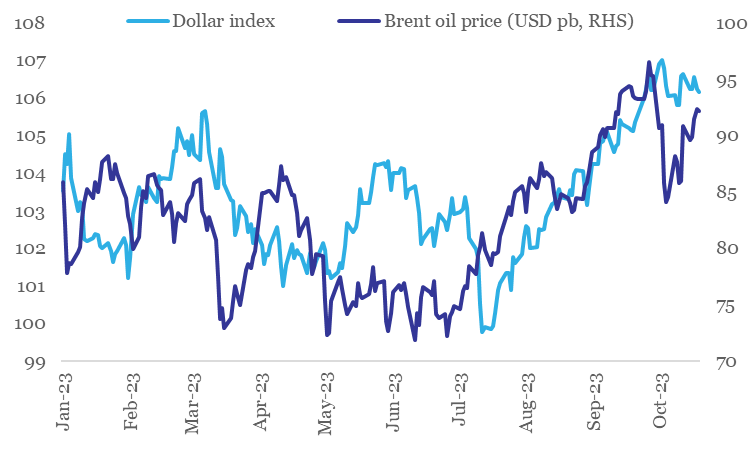

- US economic resilience has been a positive surprise, which has benefitted the dollar.

- Adverse geopolitical developments have resulted in crude oil price jumping from its recent low of USD 75 bp in May-Jun 2023 to USD 92 pb levels currently.

This makes us believe that the currency is likely to create a fresh low of close to 84 levels against the dollar by Dec-23. If Israel-Palestine conflict remains contained, going forward, we expect the INR to partially reclaim lost ground and move towards 82 levels in Mar-24 amidst favorable Q4 seasonality and anticipated USD weakness as market participants position for a pivot in US monetary policy cycle by mid-2024.

Chart 4: Since Jul-23, dollar and crude have moved against India’s favor

Data: Refinitiv, QuantEco Research